Understanding the Teller Role What You Need to Know

A teller position, often the first step in a banking career, involves direct interaction with customers, handling financial transactions, and providing excellent customer service. Tellers are the face of the bank, responsible for processing deposits, withdrawals, loan payments, and other financial activities. This role requires accuracy, attention to detail, and the ability to handle cash and sensitive information. Understanding these core responsibilities is the first step in crafting a cover letter that resonates with hiring managers. It shows you have a basic understanding of the role and are prepared to fulfill its duties. Research the specific duties of the bank’s teller position, such as opening accounts, managing safe deposit boxes, or assisting with foreign currency exchange. Showing you comprehend the importance of this role will make your application stand out.

Essential Skills for a Teller Position

While prior experience might be limited, highlighting essential skills is crucial. Even without direct banking experience, skills like customer service, communication, and attention to detail are highly transferable and valuable in a teller role. Proficiency in mathematics and basic computer skills are also important. Emphasize these abilities in your cover letter, providing specific examples of how you have demonstrated them in previous roles or situations. For example, if you have worked in retail, highlight instances where you provided exceptional customer service or resolved customer issues. Furthermore, the ability to learn new software quickly and adapt to a fast-paced environment is a significant advantage, as banking systems and procedures often evolve.

Customer Service Excellence Build Relationships

Customer service is at the heart of a teller’s responsibilities. Tellers build relationships with customers and provide them with positive experiences. Focus on any experience you have in customer-facing roles, whether in retail, hospitality, or other service industries. Describe how you handled difficult customers, resolved complaints, or went the extra mile to assist someone. Showing empathy and understanding, as well as the ability to remain calm under pressure, are essential qualities. Highlight your ability to listen actively, understand customer needs, and provide appropriate solutions. Banks highly value individuals who can create a welcoming and helpful environment for customers, so emphasizing your customer service skills is extremely important in a cover letter.

Communication Skills Clarity and Confidence

Clear and concise communication is vital for a teller. You must be able to explain financial products and services to customers clearly and accurately. Highlight your ability to communicate effectively in both written and verbal forms. Examples include experience in writing emails, reports, or interacting with clients. Confidence in your communication abilities can create a positive impression. Be sure to mention how you’ve explained complex information in a way that is easy for others to understand. It’s important to demonstrate excellent listening skills, which help you comprehend customers’ needs and provide appropriate solutions. Strong communication skills help you avoid misunderstandings and ensure customer satisfaction.

Attention to Detail Accuracy is Key

Accuracy is critical in a teller role, as even small errors can have significant financial consequences. Highlight any experience that demonstrates your ability to pay close attention to detail. This might include experience in accounting, data entry, or any role where accuracy was essential. Provide specific examples where you have successfully maintained accuracy. Tellers must handle cash, balance transactions, and process paperwork with precision. Mention your commitment to accuracy and any processes you use to ensure your work is free of errors. Mention how you ensure all transactions are completed without mistakes. Your cover letter should demonstrate your commitment to accuracy and your ability to prevent errors.

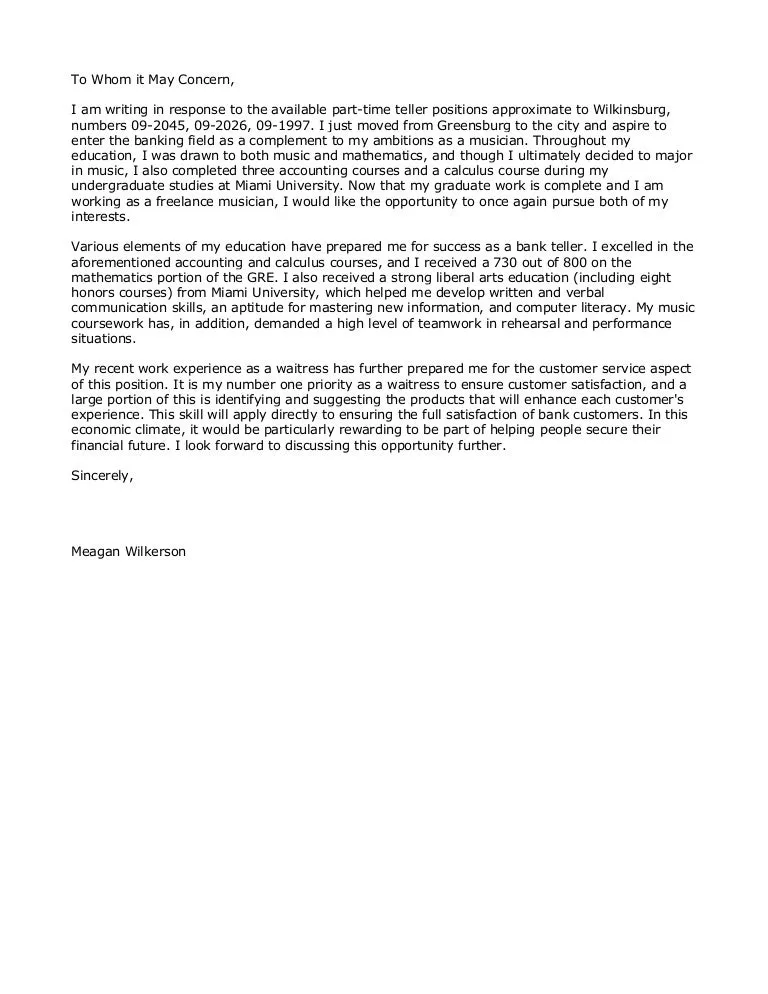

Cover Letter Strategies Without Experience

When applying for a teller position without experience, your cover letter becomes even more important. Because there is no previous employment to show, your cover letter is your first opportunity to impress the hiring manager. Your cover letter should show that you understand the requirements of the role and possess the required skills. Highlight your skills, education, and relevant experiences, even if they come from other settings. Show that you are interested in the banking sector by mentioning your knowledge of the bank and its services. Focus on qualities that demonstrate your capacity to quickly learn the job and meet the bank’s needs. You must demonstrate a genuine interest in learning and growing in the role.

Highlighting Transferable Skills Your Hidden Assets

Transferable skills are those you have gained in previous roles or experiences that are relevant to a teller position. These could be from retail, customer service, or any job where you interacted with people, handled money, or worked with data. Identify the skills that match the job requirements and include them in your cover letter. Demonstrate how you’ve used these skills in the past. Examples include handling cash in a previous job, maintaining records, or solving customer complaints. Use action verbs to describe how you utilized these skills, for instance, “Managed cash transactions accurately” or “Resolved customer issues efficiently”. This shows your ability to perform essential job duties, even without direct banking experience.

Focusing on Soft Skills What Employers Seek

Employers seek soft skills like teamwork, problem-solving, and adaptability in teller roles. Highlight these in your cover letter. Give examples of how you demonstrated these abilities. If you worked on a team, describe how you contributed to a project’s success. In cases where you had to deal with issues, explain how you came up with solutions. Banks value candidates who are versatile and able to quickly adapt to changing circumstances. Your cover letter is your opportunity to show that you can handle different scenarios and work well with others. Make sure you discuss your ability to work well under pressure, adapt to new tasks, and be punctual.

Cover Letter Structure and Formatting

A well-structured cover letter is crucial. It should be clear, concise, and easy to read. Include your contact information at the top, followed by the date and the hiring manager’s name and title, if known. Use a professional font and formatting. Ensure that the layout is organized, with clear sections and headings. Each section should have a specific purpose, such as introducing yourself, showcasing your skills, or expressing your interest. The cover letter should be no longer than one page. A well-formatted cover letter creates a positive first impression and shows that you are serious about the position.

Opening Paragraph Grab Their Attention

The opening paragraph is your opportunity to grab the hiring manager’s attention. Start by stating the position you are applying for and where you saw the job posting. Briefly explain why you’re interested in the position and what makes you a good fit. Mention something specific about the bank that interests you, such as its commitment to customer service or community involvement. Make sure you express your enthusiasm for the role and your desire to work at the bank. A strong opening paragraph sets the tone for the rest of your cover letter and encourages the hiring manager to keep reading.

Body Paragraphs Showcase Your Value

The body paragraphs are where you provide more details about your qualifications and skills. Use a few paragraphs to highlight your most relevant skills and experiences. Focus on skills like customer service, communication, and attention to detail. Provide specific examples of how you have demonstrated these skills in the past. Mention accomplishments and responsibilities that are relevant to the teller position. Use action verbs to describe your accomplishments and skills. Avoid simply restating your resume. Instead, provide additional context and show how your skills can benefit the bank. Show that you have researched the bank, and tailor your information to the bank’s mission and values.

Closing the Deal Call to Action

The closing paragraph should reiterate your interest in the position and express your desire for an interview. Thank the hiring manager for their time and consideration. Provide your contact information again and state your availability for an interview. Make sure that you are confident and enthusiastic about the opportunity. A strong closing paragraph leaves a positive final impression and increases your chances of getting an interview. Your call to action should invite the hiring manager to contact you for an interview, demonstrating your eagerness and availability.

Tailoring Your Cover Letter to the Bank

Customizing your cover letter to match the bank’s values and requirements is critical. Research the bank and its culture. Adjust the language and examples in your cover letter to align with the bank’s mission, values, and the specific requirements listed in the job description. This indicates that you care enough to prepare a personalized application. Mention any specific products or services that interest you, and explain how you can contribute to the bank’s success. Take the time to understand the bank’s mission, culture, and any recent news or initiatives. This demonstrates genuine interest and shows you are serious about the opportunity.

Researching the Bank Understanding Their Culture

Before you write your cover letter, research the bank. Learn about its products, services, and values. Visit the bank’s website and social media pages to gather information. Find out the bank’s mission statement and corporate culture. Knowing this will help you customize your cover letter to fit the bank’s specific needs and requirements. This shows the hiring manager that you are interested and prepared to be a part of the bank. Understand its customer base, its community involvement, and its commitment to customer service. Tailor your cover letter to mirror the bank’s style, language, and focus. Make the cover letter reflect what you know about the bank and its position.

Using Keywords to Optimize Your Letter

Use keywords from the job description to make your cover letter stand out. Review the job description and identify key skills, qualifications, and requirements. Incorporate these keywords into your cover letter, such as in the skills section, or when describing past experiences. Use these keywords naturally within the text. Avoid keyword stuffing, which makes the letter seem unnatural. This helps your cover letter pass through any applicant tracking systems (ATS) used by the bank. It also helps the hiring manager quickly identify that you have the required skills. This is one way to ensure your application is seen by a hiring manager and considered for the position.

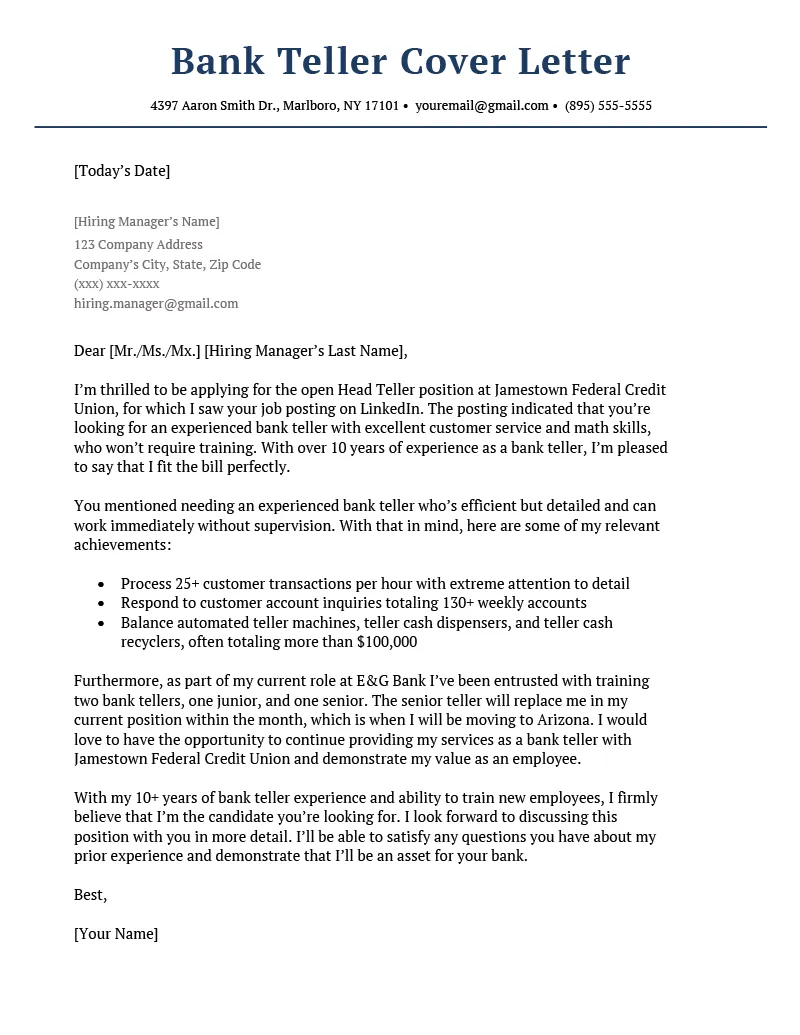

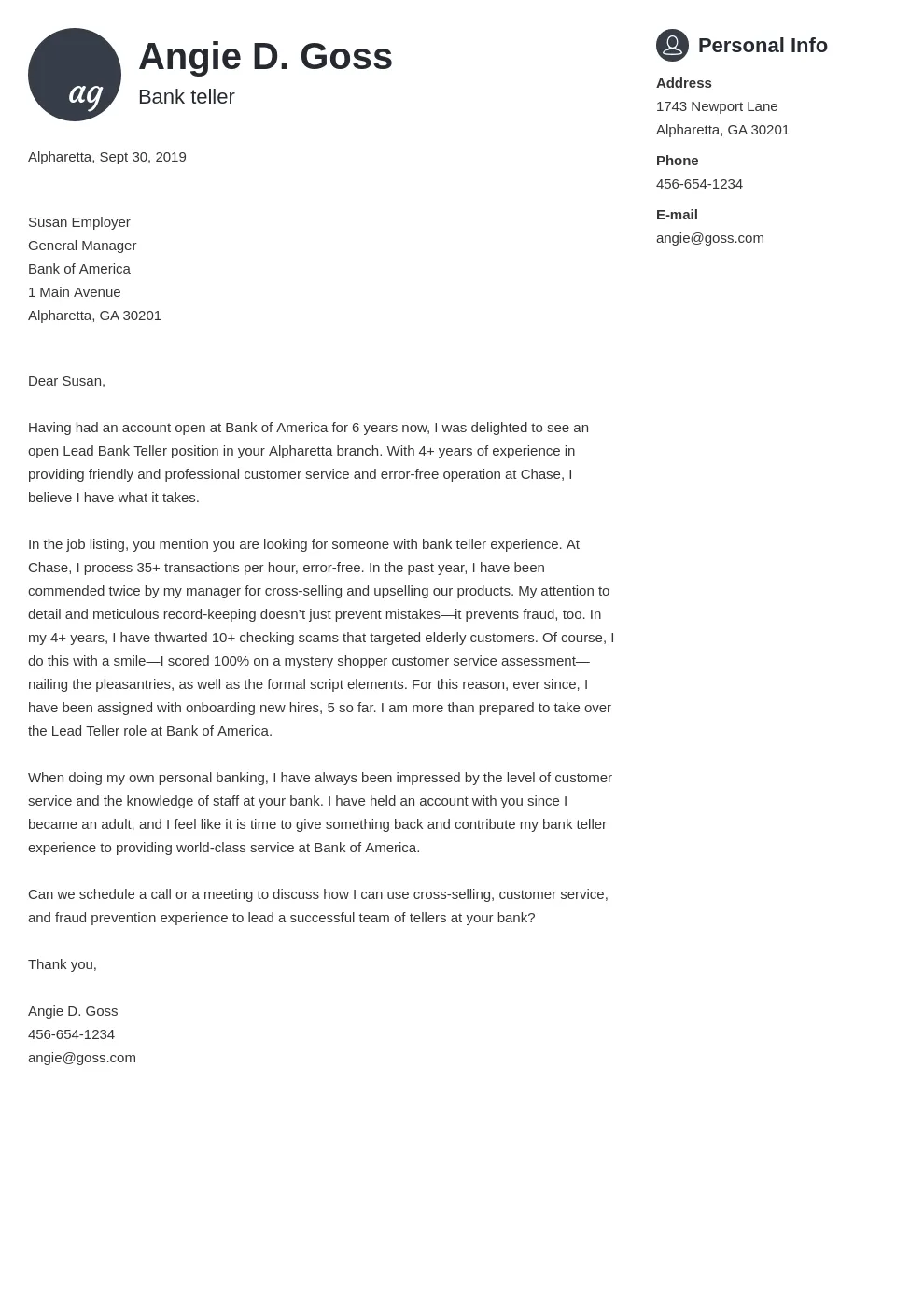

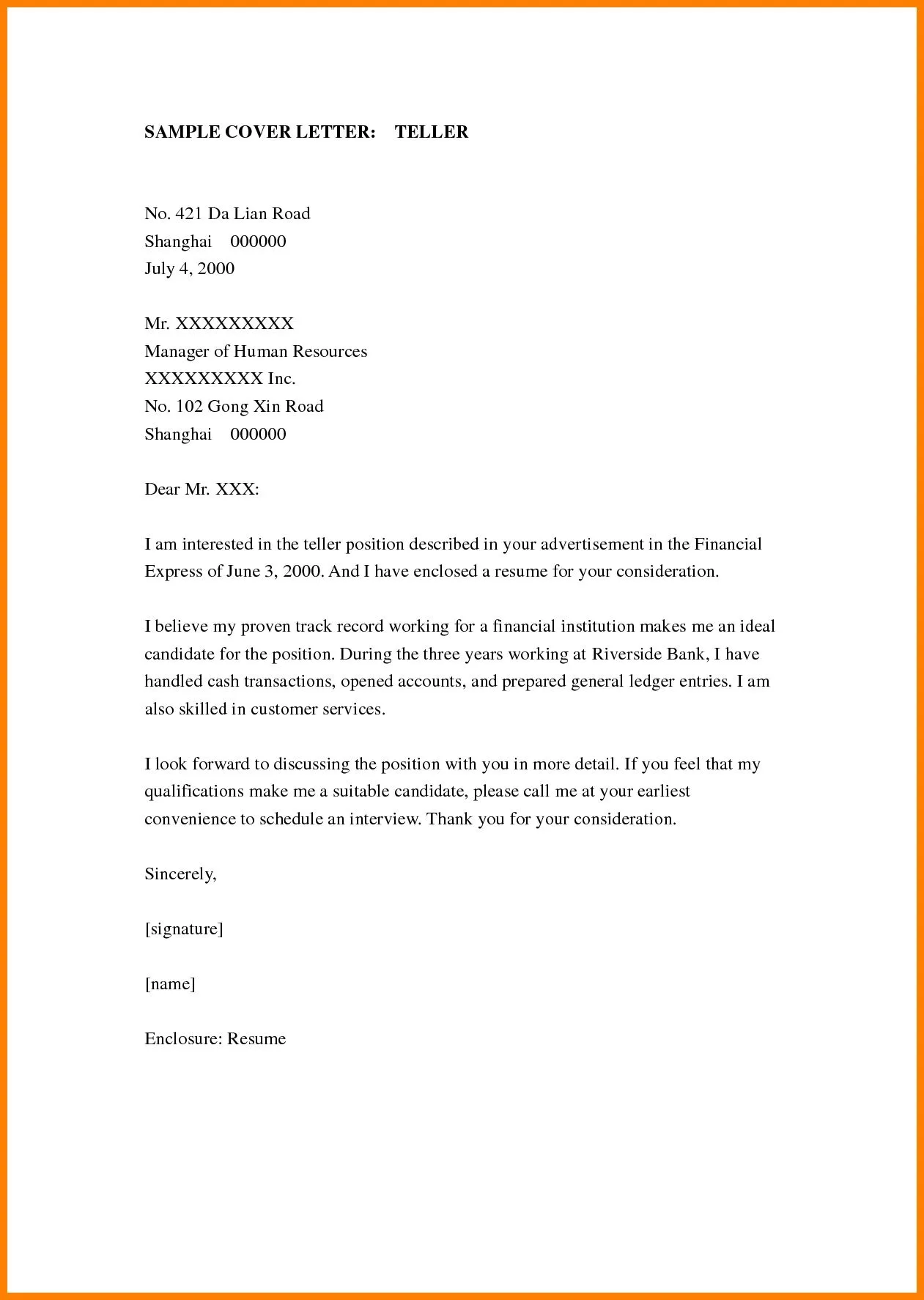

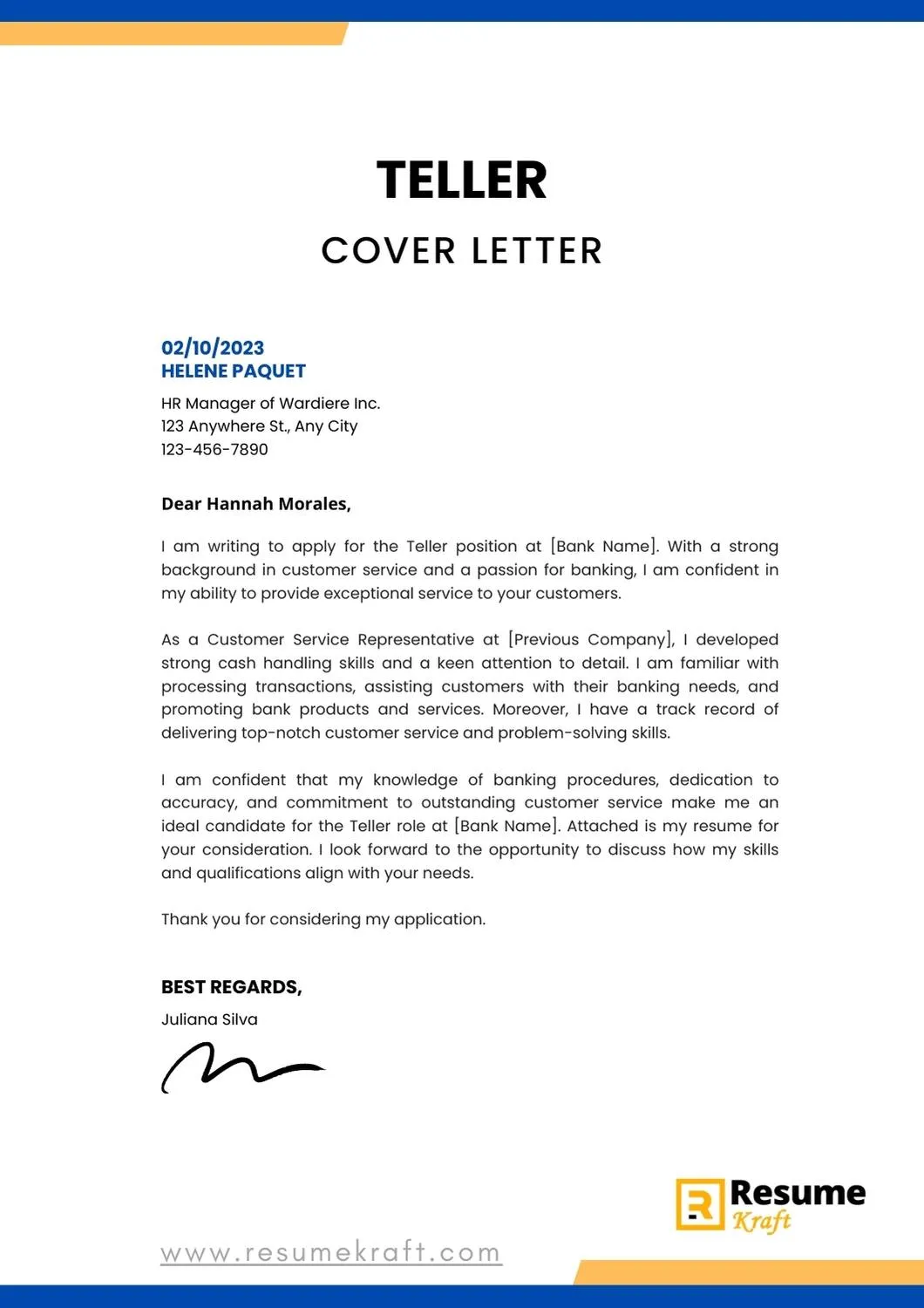

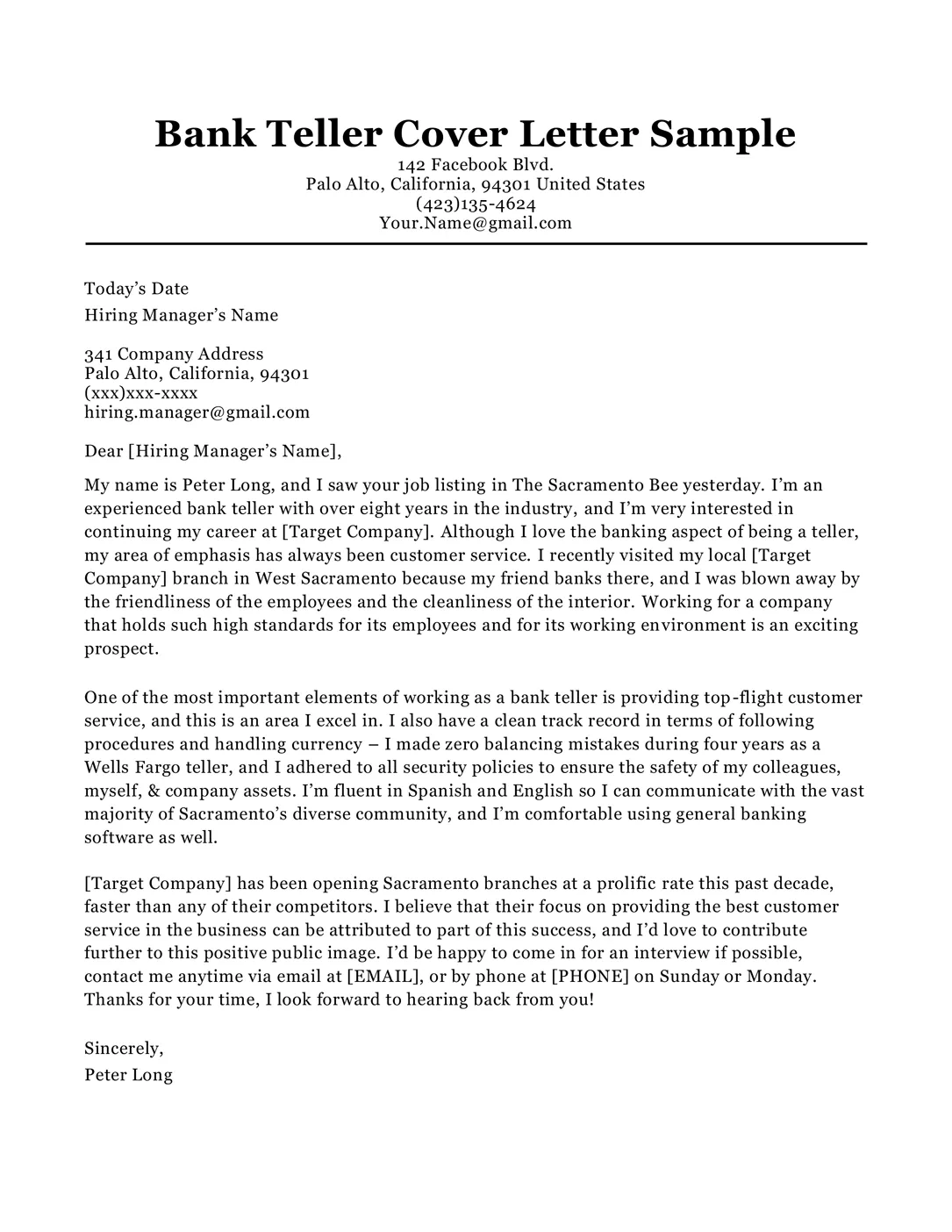

Cover Letter Examples and Templates

Reviewing cover letter examples and templates can help you write your own. Search for cover letter examples for teller positions online. Use these examples as a guide when writing your cover letter. Adapt the format and content to match your own experience and the specific requirements of the job. Pay close attention to the structure, tone, and language used in the examples. Tailor the template to your needs, by including your own skills and accomplishments. Review several examples. Look for the best practices and common characteristics that set successful cover letters apart. This will help you avoid common mistakes and create a professional and effective cover letter.

Example Cover Letter Analysis What Works

When analyzing examples, pay attention to what makes the cover letters successful. Focus on the opening paragraph, which grabs the reader’s attention. Look at how skills and experiences are presented. Study the use of action verbs and the overall tone. Note how the applicants tailor their cover letters to the specific bank and the job description. The best cover letters clearly and concisely explain how the applicant’s skills and experiences match the job requirements. They highlight the applicant’s personality and enthusiasm. By analyzing these elements, you can learn how to write a successful cover letter that shows the bank’s hiring manager why you’re the ideal candidate.

Template Adaptation Customizing for Success

Adapt the cover letter templates to match your experiences and the specific job description. Make sure the structure is easy to follow, with a clear opening, body, and closing. Modify the content to highlight your unique skills and accomplishments. Customize the language to align with the bank’s culture and the requirements of the job. The goal is to showcase how you can meet the bank’s needs. Remove any generic or irrelevant information and replace it with information that showcases your qualifications. Keep in mind the bank’s mission and values. The final goal is a cover letter that shows why you’re the best candidate for the job.

Proofreading and Editing Perfection Matters

Proofreading and editing are crucial to ensure your cover letter is polished and error-free. Check for grammar, spelling, and punctuation errors. Read the cover letter aloud to catch any awkward phrasing or sentence structure issues. Use grammar and spelling checkers, but don’t rely on them completely. Ask a friend or family member to review your cover letter and provide feedback. Eliminate typos and grammatical errors. Your cover letter must make a positive impression, and it must be free of errors. Careful editing and proofreading demonstrate your attention to detail. This shows that you are a professional and reliable candidate.

Common Mistakes to Avoid

Avoid common mistakes that can damage your chances of getting the job. Do not submit a cover letter that is full of errors, generic, or poorly formatted. Avoid using vague language or exaggerating your skills or experiences. Do not be negative or mention anything critical about previous employers. Do not forget to tailor your cover letter to the job description and the bank. Make sure you do not include information that is irrelevant to the position. Ensure your cover letter aligns with the bank’s brand. Make your cover letter as professional and polished as possible. Ensure you are not exceeding one page.

Grammar and Spelling Errors

Grammar and spelling mistakes can make your cover letter look unprofessional. Errors show a lack of attention to detail. Before submitting, carefully review your cover letter for mistakes. Use a grammar and spelling checker, but don’t rely on these tools alone. Mistakes can also make the cover letter difficult to read. Ensure your cover letter shows your professionalism. A cover letter with errors could result in it getting immediately discarded.

Generic Cover Letters

Generic cover letters often lack personalization. Hiring managers can easily recognize generic letters, which show a lack of effort. Tailor your cover letter to the specific job and bank. Customize your cover letter to show you understand the job requirements. Personalize your cover letter by highlighting your relevant skills and experiences. If you personalize your cover letter, it will demonstrate genuine interest and increase your chances of getting an interview.

Next Steps After Submitting

After submitting your cover letter and resume, take the initiative to follow up. Check your application status online. Wait for the designated timeframe before following up with the hiring manager or the HR department. Write a thank-you note after your interview. The next steps after submitting your application can influence your chances of getting the job. Always be polite and professional in your communications. Continue searching for job openings and applying until you receive an offer.

Following Up After Applying

Following up after applying can show your interest and initiative. Usually, the hiring manager will give a timeframe to expect a response. Be patient and wait for that timeframe. If you haven’t heard back after a reasonable amount of time, send a polite follow-up email. In your email, reiterate your interest and attach your resume again. Keep the email brief and professional. Make sure you address the hiring manager correctly and spell their name right. Do not call frequently, as this can irritate the hiring manager.

Preparing for the Interview

If you get an interview, prepare thoroughly. Research the bank and the teller role. Practice answering common interview questions. Have examples ready to demonstrate your skills and experiences. Prepare questions to ask the interviewer. This shows you have done your research and you are genuinely interested in the position. Dress professionally and arrive on time. Have extra copies of your resume and cover letter with you. A good interview can make up for any gaps in experience. Your interview preparation is an investment in your future.

Conclusion Your Path to Teller Success

Crafting the perfect cover letter for a teller position requires a strategic approach. By understanding the role, highlighting transferable skills, and tailoring your application to the bank, you can significantly increase your chances of getting hired. Remember to focus on your customer service skills, communication abilities, and attention to detail. A well-written cover letter with these components will help you stand out. Tailor the cover letter to the bank, and always proofread. You are on your way to a successful career in banking, following these guidelines and demonstrating your capabilities. With the right approach and a well-crafted cover letter, you can start a successful career as a teller.